Terms & Conditions: Save the Student £5 Amazon voucher promotion

1. Who is eligible? - All users of the Save the Student website. - Existing customers of Snoop are not eligible for the promotion. - To be eligible, you must not be using Ad blocking software on your Phone – it’s not possible to identify eligible claims when blocking software is used.

2. What is the promotion? - Eligible Save the Student users can earn £5 for trying the Snoop app. - To earn the reward, new users must use the specified tracking link on the Save the Student website to download the app (so they can be identified for the reward), connect at least one bank account or credit card and still have the app installed at the end of the month following the month of download. - Those that have downloaded the app via the tracking link will get an email containing a reminder of these terms and conditions and details of the voucher. - Vouchers will be paid at the end of the month following that in which the customer installs the app and connects at least 1 bank account. As an example, if a customer installs the Snoop app and connects their bank account in March, the voucher will be paid at the end of April. If the end of the month falls on a weekend, the voucher will be paid on the Monday following the weekend (or Tuesday if Monday is a bank holiday)

4. What is the voucher value? - The voucher value payable to a new Snoop user will be £5.00. - Only one voucher can be earned per customer. Multiple downloads and account setups are not eligible. - The voucher provided will be a £5 Amazon voucher – no cash exchanges or alternative vouchers will be provided.

5. What else do you need to know? - This promotion can be withdrawn at any time. - Your personal information (the email address used to register for Snoop) will be used to send you the £5 voucher. - This offer is only available in the UK (as that’s where Snoop operates). - If an event beyond our control happens and means we can’t supply a voucher we may change the reward (but we’ll try not to).

6. Who are Snoop? - We are Usnoop Limited. - Our company number is 11797870. - Our registered address is: Usnoop Ltd, 10 Norwich Street, London, United Kingdom, EC4A 1BD.

Why use Snoop?

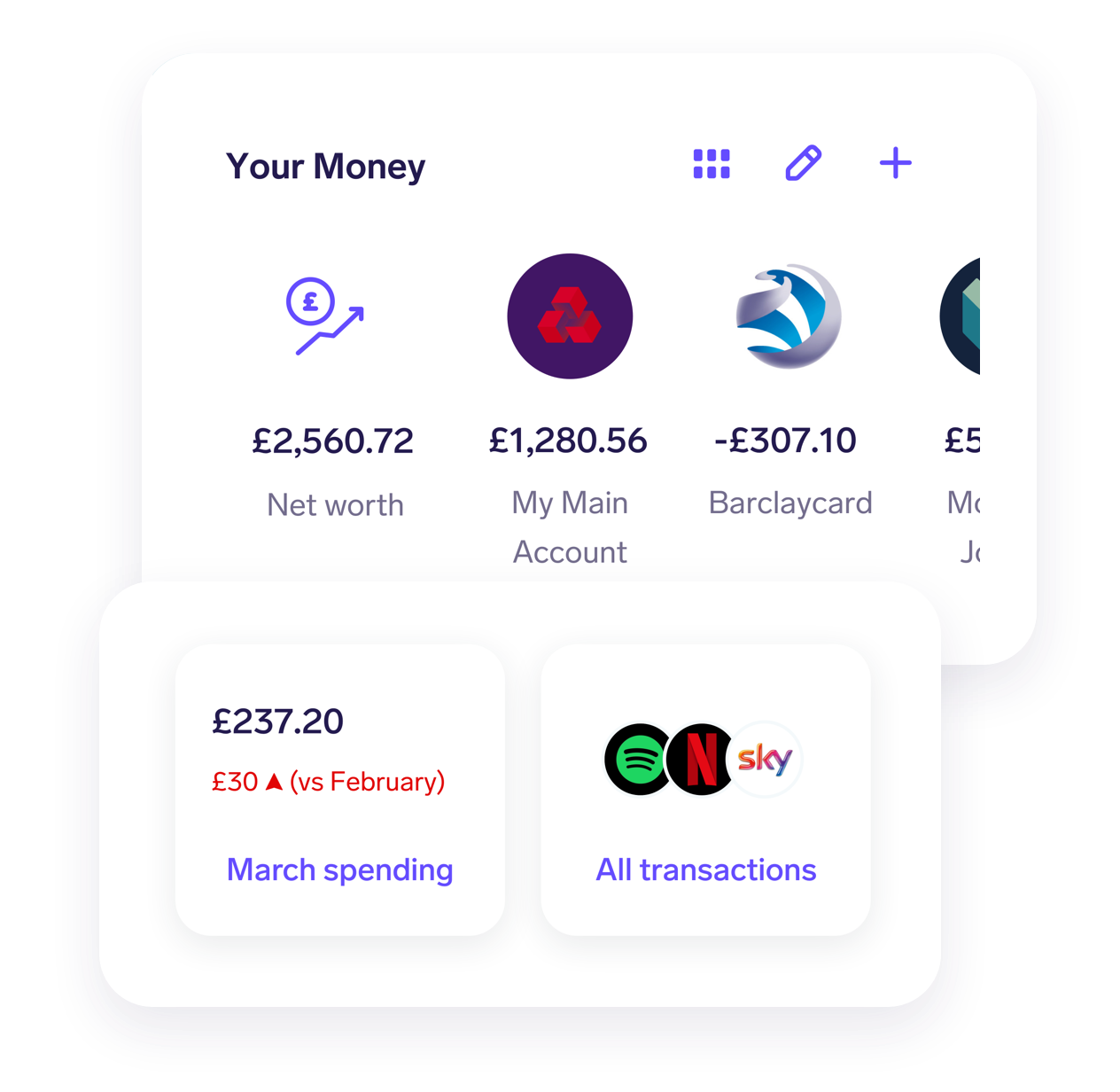

See all your bank accounts together

Connect your bank accounts and credit cards, and Snoop can show all your info in one place.

Pay less for your bills

Snoop’s always tracking who’s taking your money to check you’re not overpaying on your bills.

When you’re signed up to Snoop, you’ll get access to special offers and exclusive deals to help cut your costs.

Even if you aren’t signed up, you can still use the switching services on our website to get a better deal.

Track where every penny goes

Personalised spend analysis helps you track your spending by category (e.g. groceries) or merchant. See how you’re doing against last month, anytime.

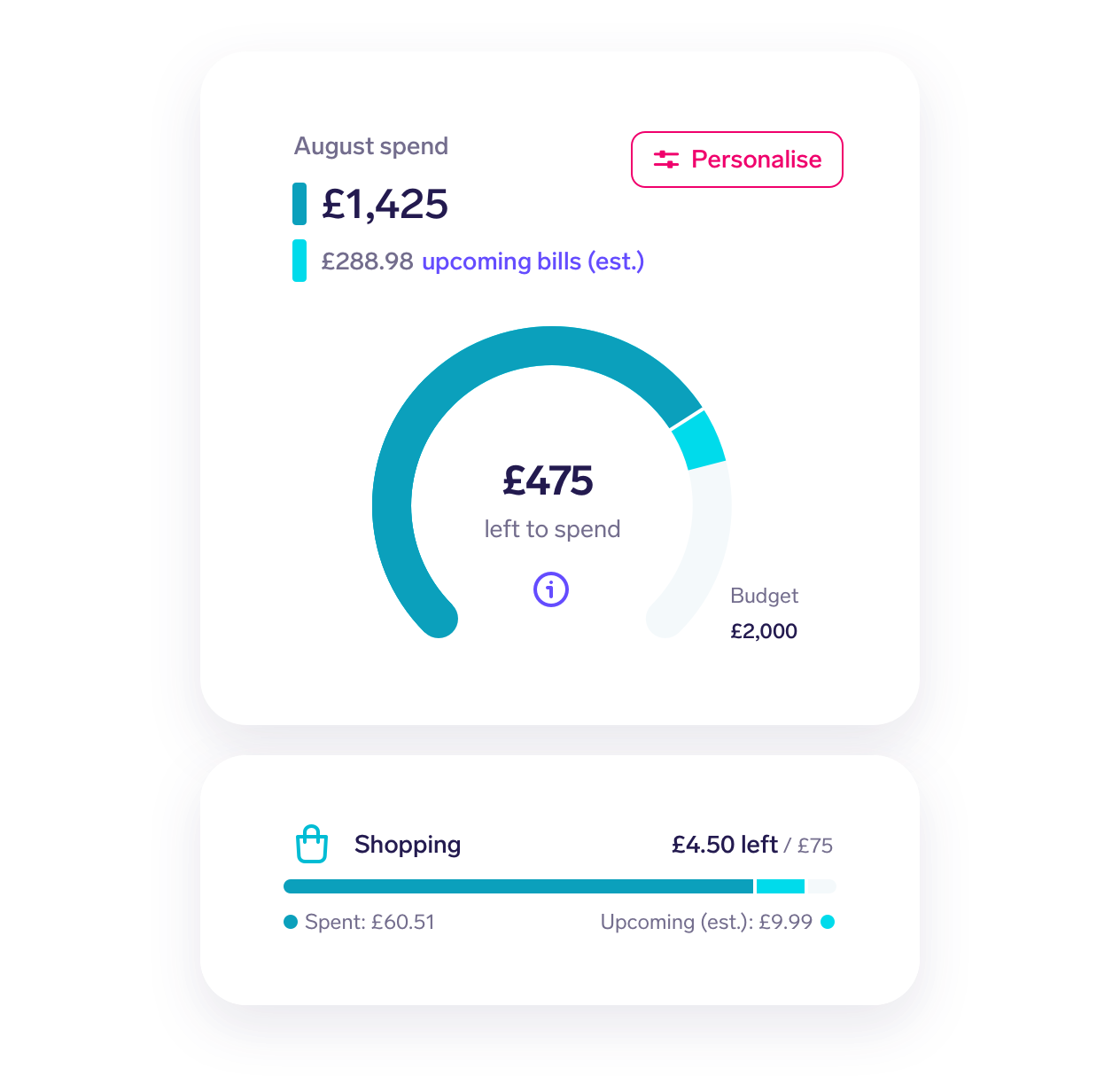

Set an instant budget in two taps

Create budgets for your monthly spend and each spending category. You can build your budgets from scratch or let Snoop set them for you.

Save where you spend

Snoop will find clever ways for you to save money at the places you already spend. We call them Snoops.

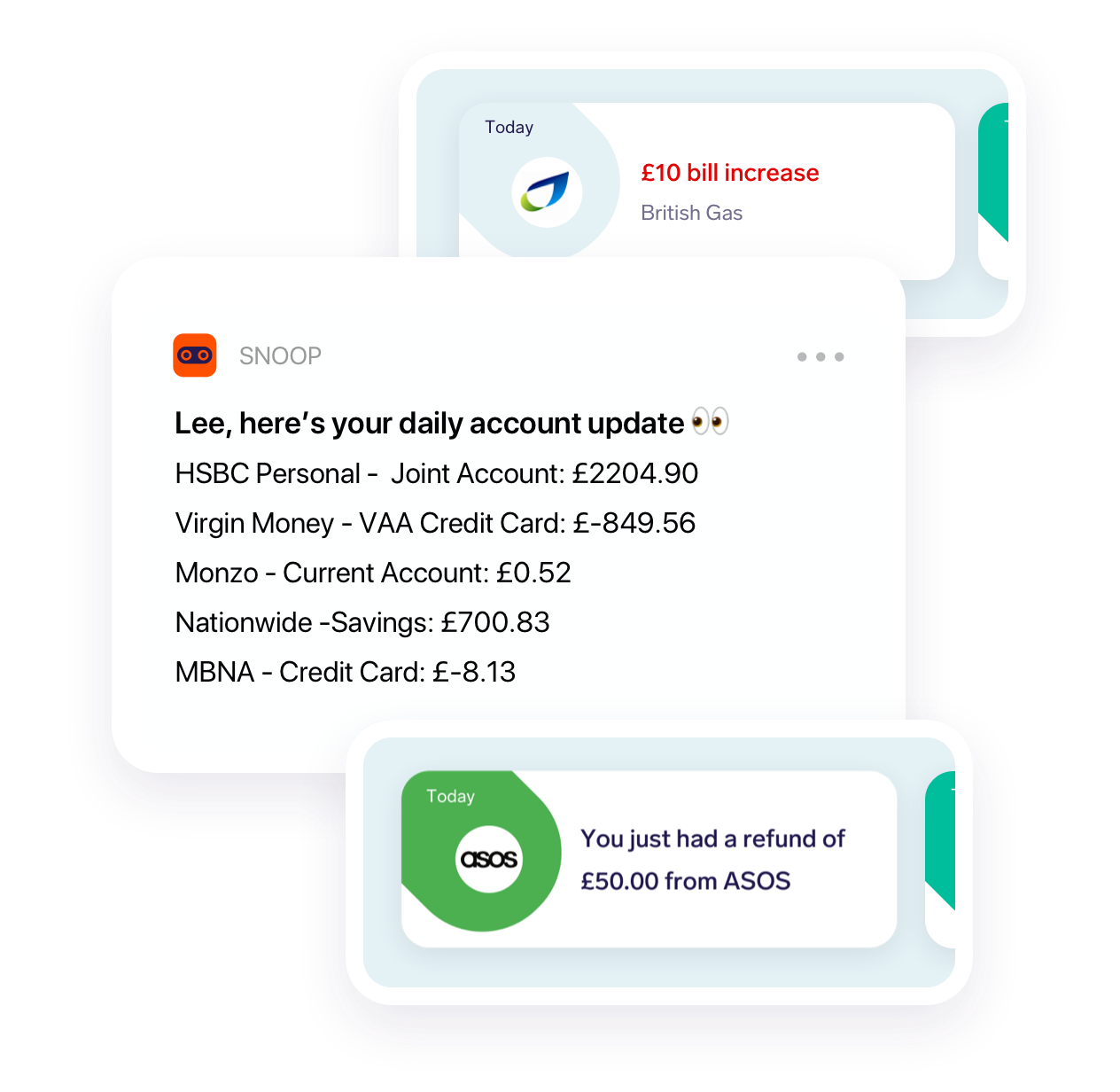

Relax knowing Snoop's monitoring your money

Snoop will highlight anything that needs your attention, from daily account balances to bill increases – and can even warn you when your bills may not be covered.

Here’s how Snoop saves you money...

Based on your spending habits, Snoop helps you:

Cut your bills

Stop subscriptions you don’t use

Avoid bank penalty fees

Set a budget and track spend vs it

Find vouchers and sales at the places you shop

Spot unexpected price hikes

Track refunds

Switch suppliers at the right time

Snoop's powered by secure Open Banking tech

Snoop uses super-secure tech – developed in partnership with your bank – to connect your accounts. We never see your bank login details. Snoop's guide to Open Banking

Frequently asked questions

Do I have to connect a bank account?

You need to connect at least one bank or credit card account to use Snoop. By doing this you allow us to identify ways you could be better off based on your actual spending patterns and choices. It also means you can keep track of your spending and set a budget. We support all of the large UK banks and we are adding more accounts all the time. Our app will always show which banks are supported at any time.

How does Snoop keep my info safe?

Snoop's money management app connects your accounts through Open Banking using the latest secure tech:

- Snoop has the same high standards of security as your bank.

- Snoop won't see or ask for your bank password or login details.

- We're registered with the Financial Conduct Authority.

So you're in super-safe hands.

How does Snoop make money?

Snoop makes money when you save money.

- Bill switching services

Switch to a new service using Snoop and your new supplier may pay us (just like a price comparison website). We earn money when you save money, simple as that. - Building intelligent insight

We help other businesses spot spending trends by anonymising all the transaction data we hold. Your personal data is NEVER used. - Our Snoop Plus service

You can sign up for our Snoop Plus service for an even more advanced money management and budgeting app experience. All for £4.99/mth or £39.99/year.

What are people saying?

Really useful

Month on month tracking by category and merchant really helps to see habits and make positive changes. Definitely helped me to save money and spend more mindfully

Traclacca

Snoop is playing an important ongoing role in fiscal responsibility at the Fish household!

James Fish

Great app

I identified a recurring payment that I was unaware of and claimed back over £700! Thanks Snoop!

Benster25

Read more reviews on the App Store or Play Store