Cut the cost of living with Snoop

We all need extra help cutting costs right now Snoop is a free app that helps you track your spending more closely and finds you new ways to save money - things you might not have spotted. It could save you £1,500 a year*.

Why use Snoop?

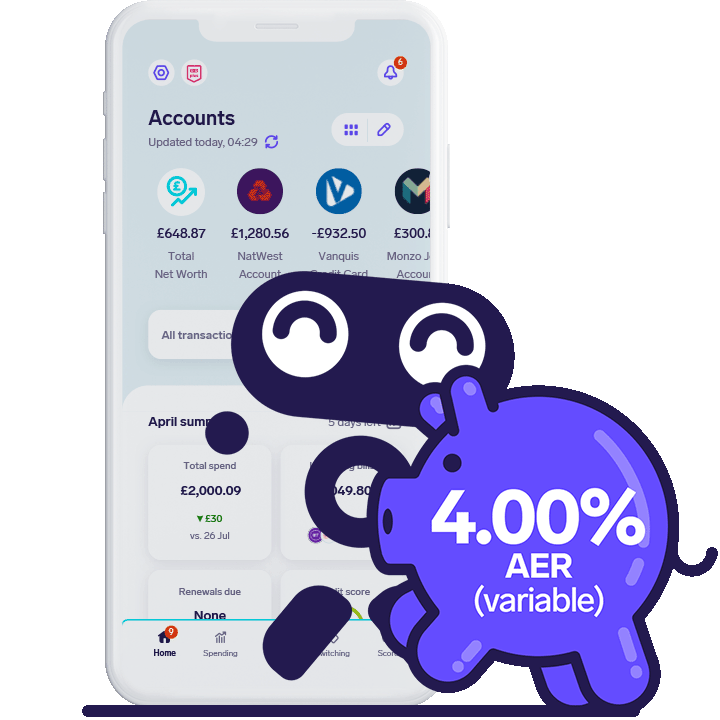

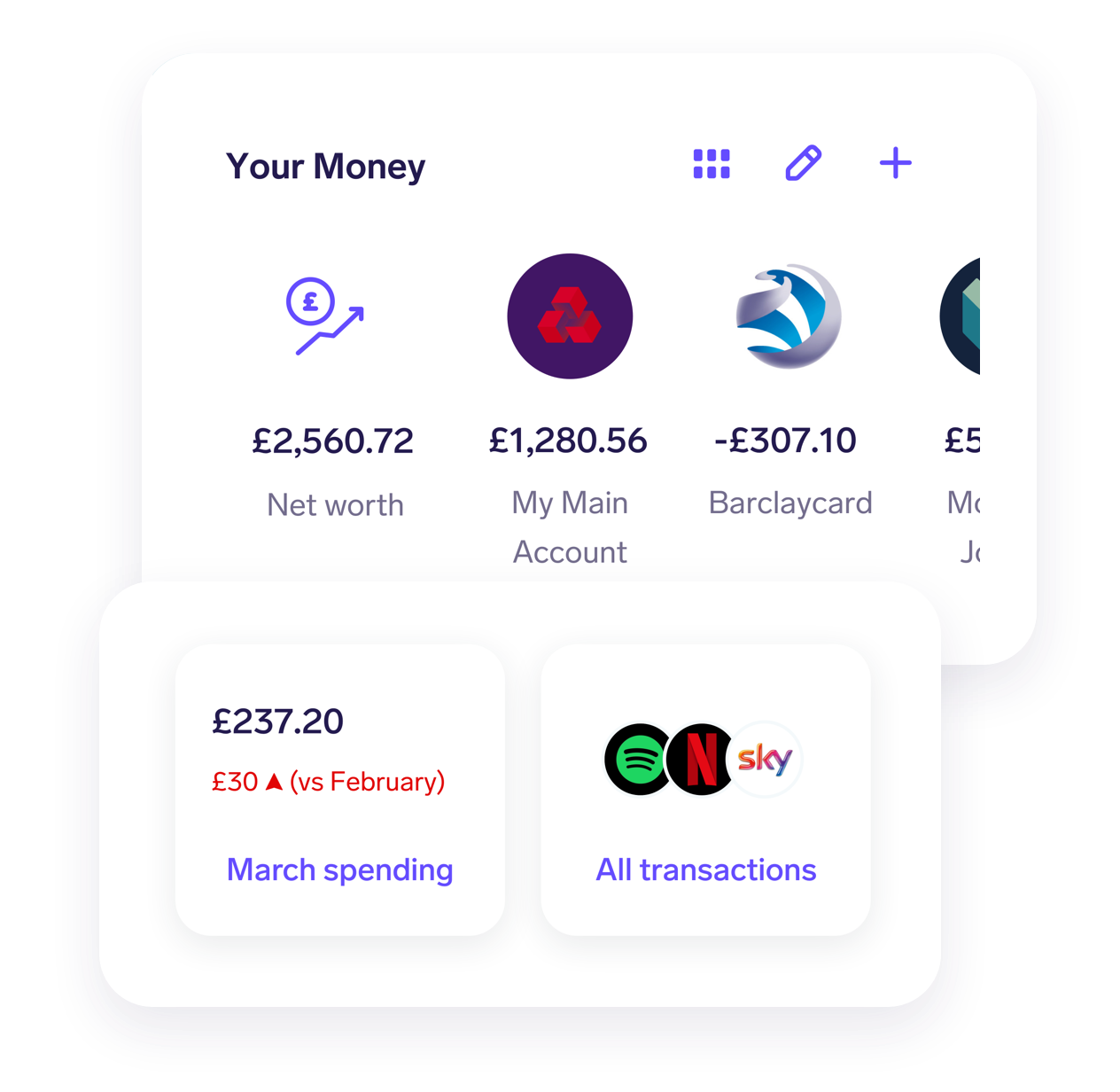

See all your bank accounts together

Connect your bank accounts and credit cards, and Snoop can show all your info in one place.

Pay less for your bills

Snoop’s always tracking who’s taking your money to check you’re not overpaying on your bills.

When you’re signed up to Snoop, you’ll get access to special offers and exclusive deals to help cut your costs.

Even if you aren’t signed up, you can still use the switching services on our website to get a better deal.

Track where every penny goes

Personalised spend analysis helps you track your spending by category (e.g. groceries) or merchant. See how you’re doing against last month, anytime.

Set an instant budget in two taps

Create budgets for your monthly spend and each spending category. You can build your budgets from scratch or let Snoop set them for you.

Track your credit score

Check your credit score in Snoop for free. Understand what affects it and get pointers on how to improve it.

Build your savings directly in the app

Open a savings account in Snoop and see your savings alongside your spending. Pay money in, earn interest each day and watch your balance grow – all through the app.

Save where you spend

Snoop will find clever ways for you to save money at the places you already spend. We call them Snoops.

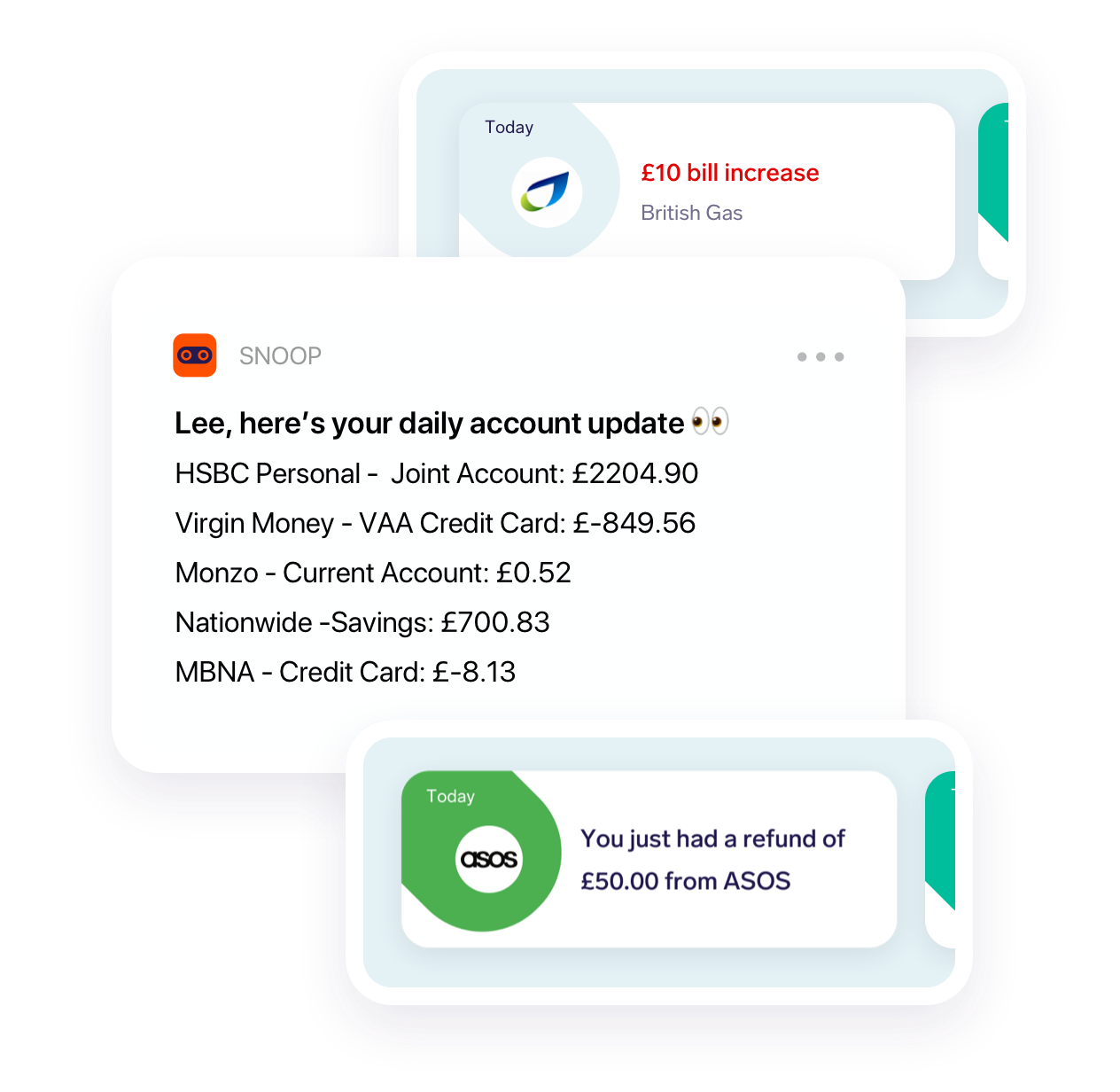

Relax knowing Snoop's monitoring your money

Snoop will highlight anything that needs your attention, from daily account balances to bill increases – and can even warn you when your bills may not be covered.

Here’s how Snoop saves you money...

Based on your spending habits, Snoop helps you:

Cut your bills

Stop subscriptions you don’t use

Avoid bank penalty fees

Set a budget and track spend vs it

Find vouchers and sales at the places you shop

Spot unexpected price hikes

Track refunds

Switch suppliers at the right time

Snoop's powered by secure Open Banking tech

Snoop uses super-secure tech – developed in partnership with your bank – to connect your accounts. We never see your bank login details. Snoop's guide to Open Banking

Frequently asked questions

Do I have to connect a bank account?

You need to connect at least one bank or credit card account to use Snoop. By doing this you allow us to identify ways you could be better off based on your actual spending patterns and choices. It also means you can keep track of your spending and set a budget. We support all of the large UK banks and we are adding more accounts all the time. Our app will always show which banks are supported at any time.

How does Snoop keep my info safe?

Snoop's money management app connects your accounts through Open Banking using the latest secure tech:

- Snoop has the same high standards of security as your bank.

- Snoop won't see or ask for your bank password or login details.

- We're registered with the Financial Conduct Authority.

So you're in super-safe hands.

How does Snoop make money?

Snoop makes money when you save money.

- Bill switching services

Switch to a new service using Snoop and your new supplier may pay us (just like a price comparison website). We earn money when you save money, simple as that. - Building intelligent insight

We help other businesses spot spending trends by anonymising all the transaction data we hold. Your personal data is NEVER used. - Our Snoop Plus service

You can sign up for our Snoop Plus service for an even more advanced money management and budgeting app experience. All for £5.99/mth or £47.99/year.

What are people saying?

Really useful

Month on month tracking by category and merchant really helps to see habits and make positive changes. Definitely helped me to save money and spend more mindfully

Traclacca

Snoop is playing an important ongoing role in fiscal responsibility at the Fish household!

James Fish

Great app

I identified a recurring payment that I was unaware of and claimed back over £700! Thanks Snoop!

Benster25

Read more reviews on the App Store or Play Store