How it works

Connect to Snoop for a smart new way to see and manage your money. Here's how to get the best out of the app...

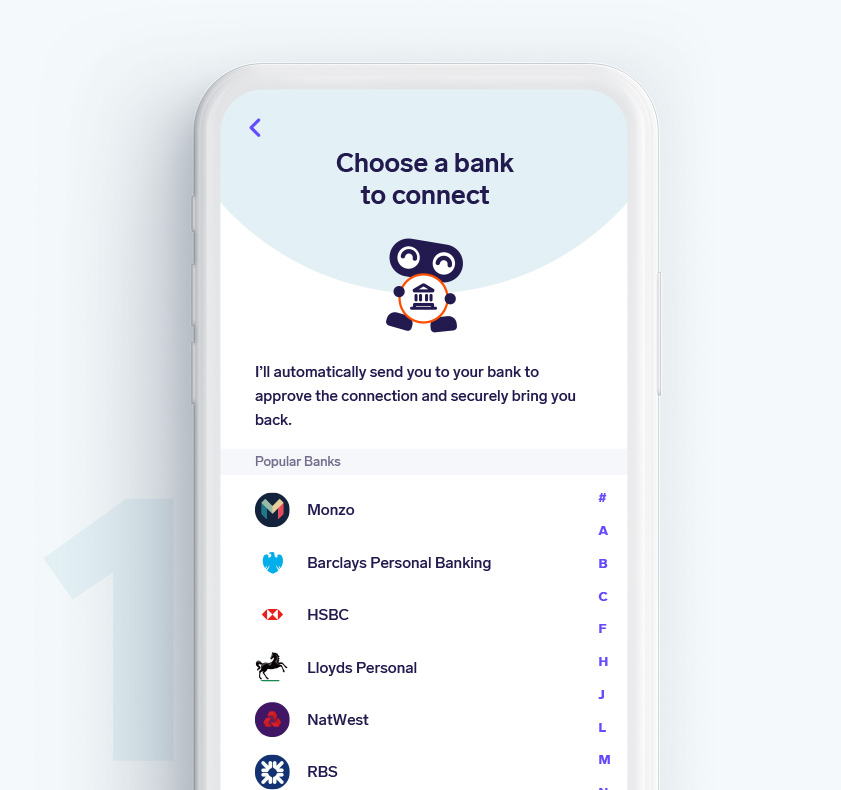

Connect a bank account or credit card

We support over 50 banks – all the big names and more. Find out why it’s safe and secure on our security page.

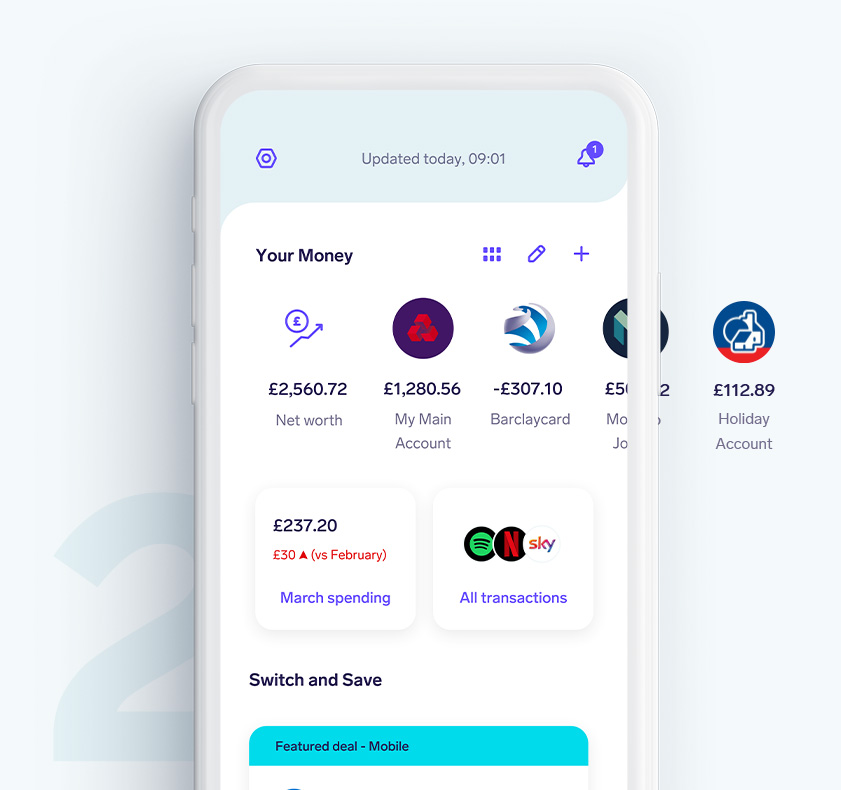

See all your money in one place

Once you’re connected, Snoop lets you see all your transactions in one app.

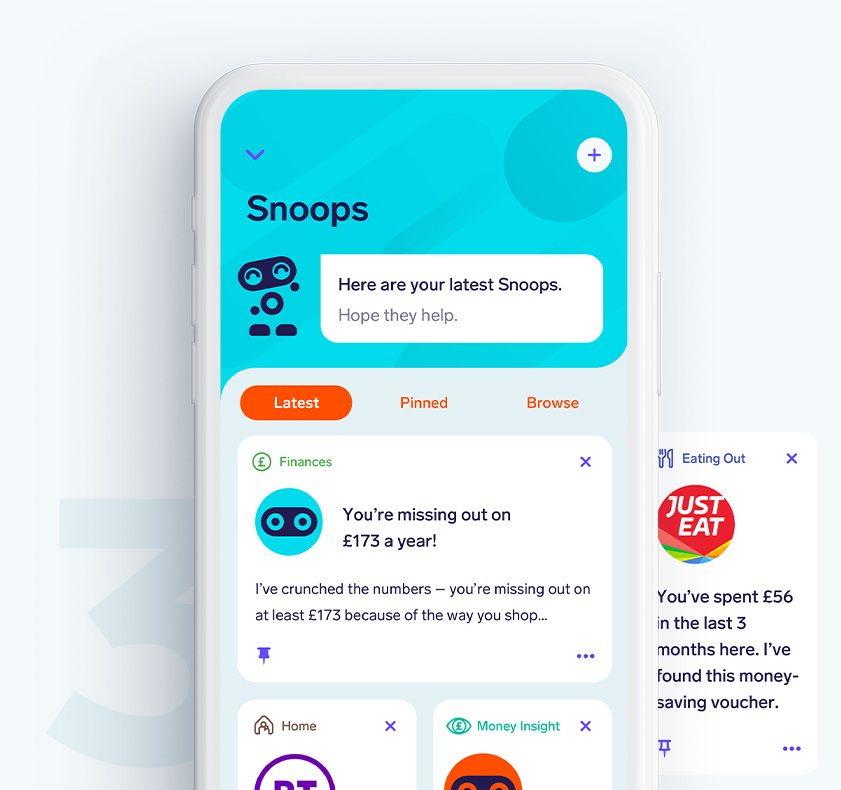

Check your personalised money-saving suggestions

Every day, Snoop creates a 100% personalised set of money-saving suggestions – just for you.

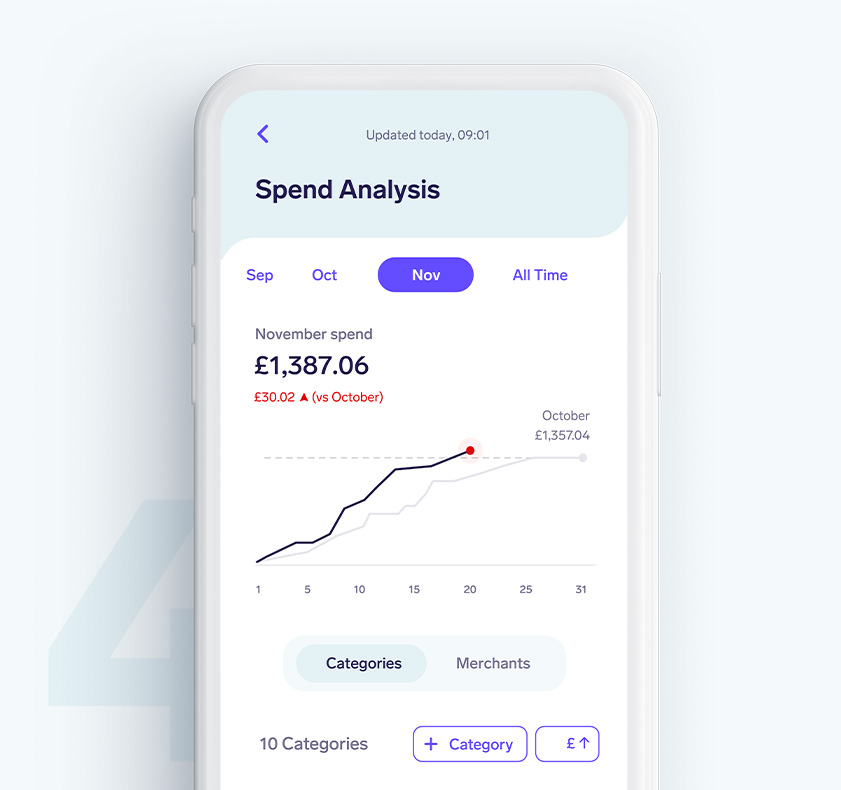

Track your spending vs last month

Do a quick check to see if you’re spending more or less than last month.

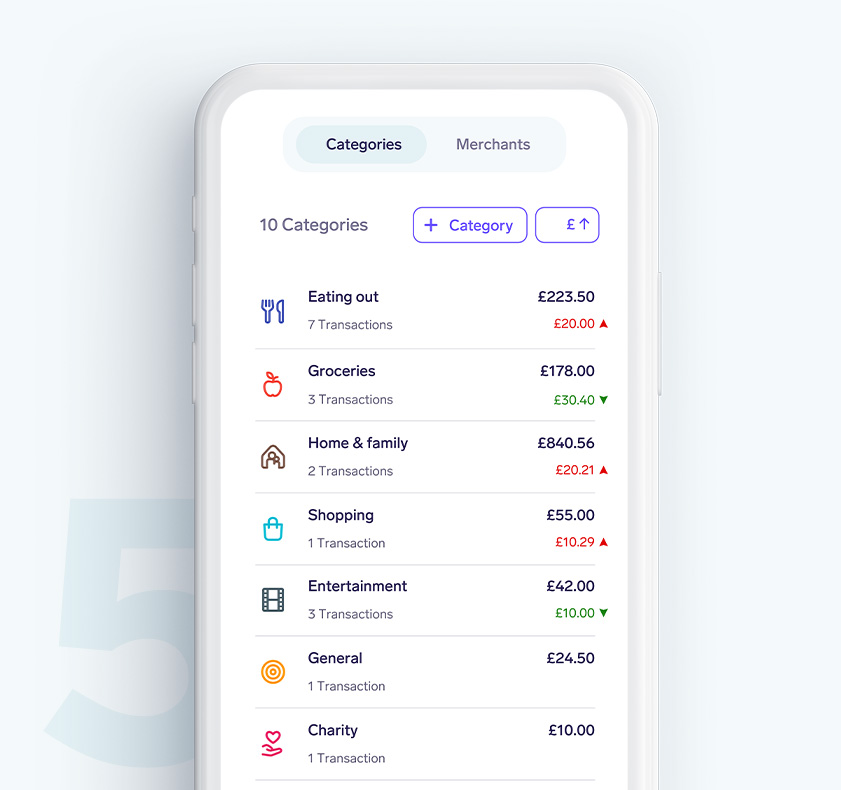

Review your spending by category

Snoop automatically categorises your spending – see what’s changing and where your money’s going.

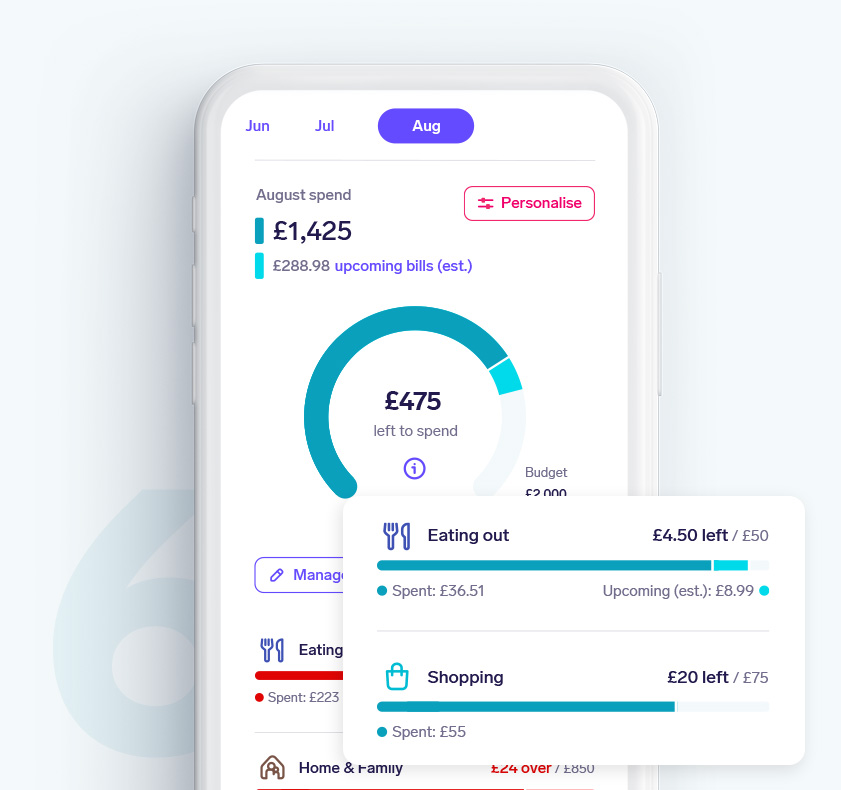

Set an instant budget to control your spending

Create budgets for your monthly spend and any category spending you want to track (e.g. groceries).

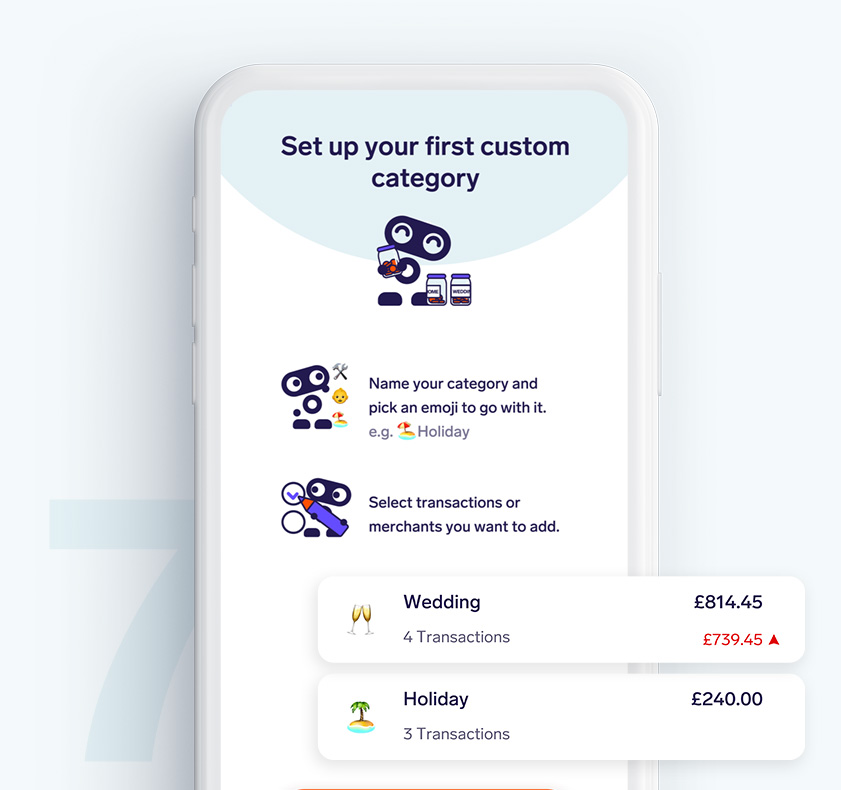

Create custom categories so you can see things your way

Want to track the cost of a wedding, building project or just Friday night takeaways? No problem.

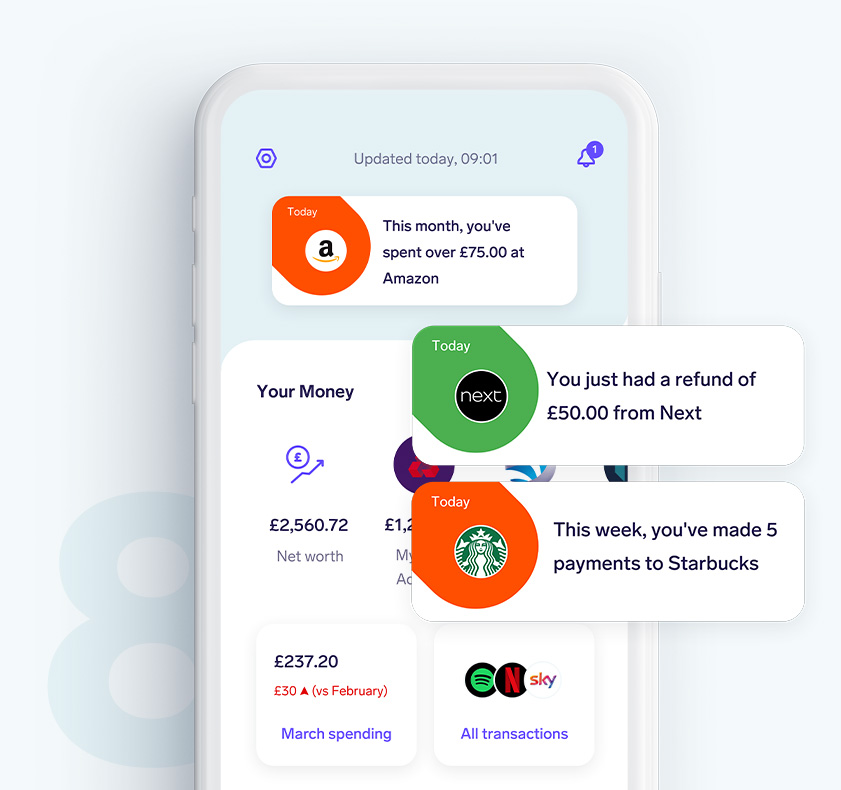

Set custom alerts and relax knowing Snoop’s on it

Daily balance updates, upcoming bills, weekly and monthly spending summaries. Get some or all. You choose.

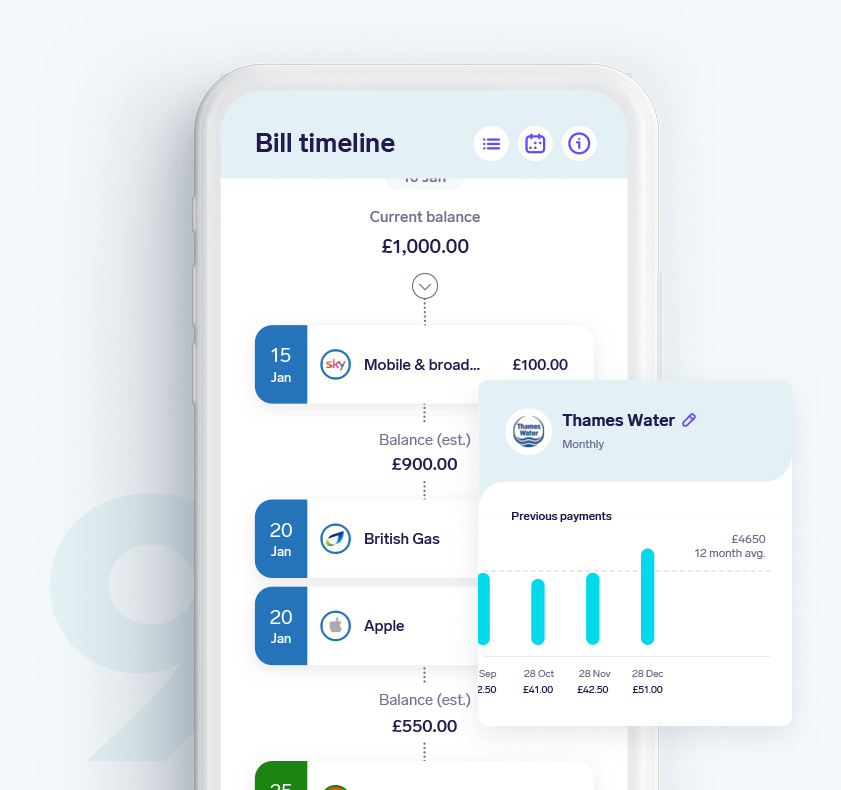

Keep on top of your household bills

Snoop keeps a close eye on your bills, flagging price hikes and better deals – and warning if your bills may not be covered.

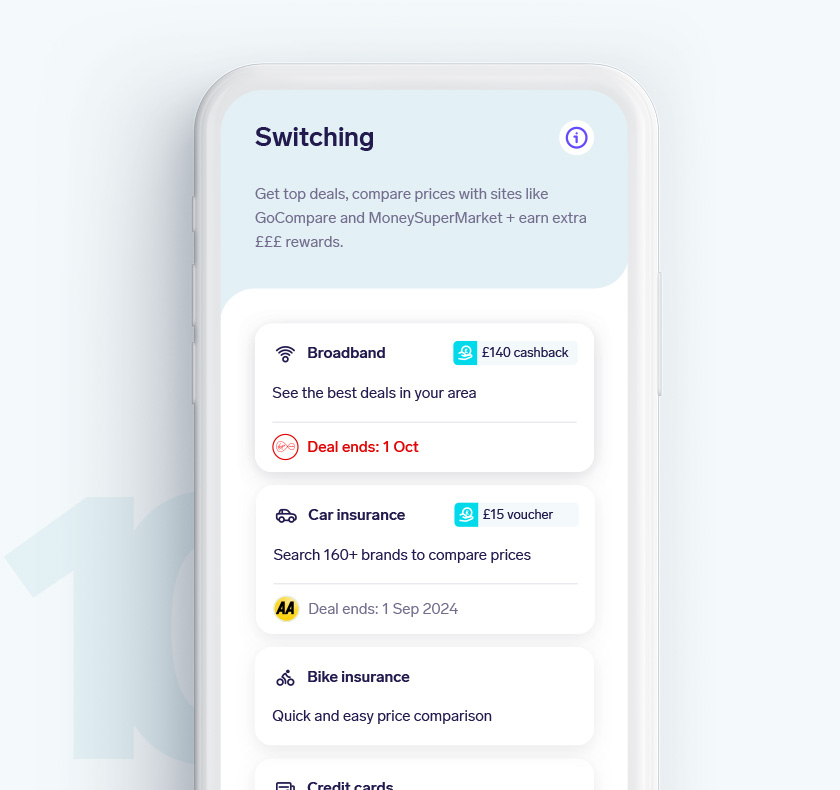

The right offers at the right time

Snoop will spot when it’s time for you to switch, so you don’t miss out.